Officially listing, Hung Thinh Incons (HOSE: HTN) has become a new factor in the listed construction sector and is a reliable choice of investors.

According to statistics of Vietstock, 122 listed construction enterprises generated revenue of over VND 95,000 billion in the first 9 months of 2018, an increase of about 7% compared to the same period last year. However, the total profit reached VND 5.375 billion, a significant decrease compared to the same period last year.

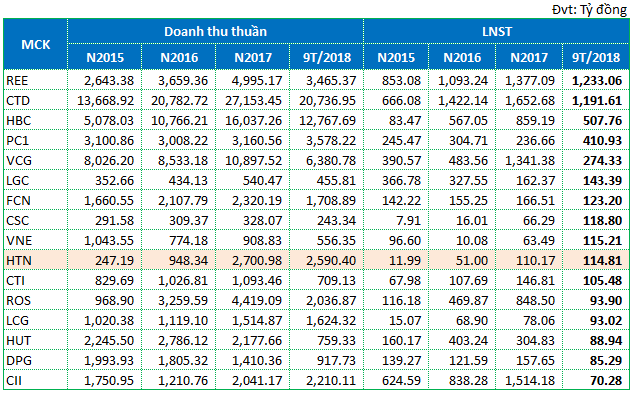

In the first 9 months of 2018, profits of big players in the sector - REE, CTD and HBC occupied the top 3 position in the sector. More notably, the new factor - HTN has just been listed with the capital of only VND 250 billion but has been ranked among the top 10 most profitable enterprises in the construction sector. If considering only the group of enterprises with charter capital of less than VND 700 billion, the profit of HTN is the highest.

Top 15 listed construction enterprises have the highest profit in 9 months of 2018

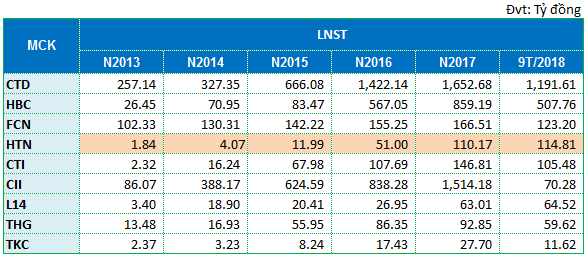

However, considering the last 5 years (2013-2017), only 9 enterprises kept their profit growth continuously, in which HTN was quite outstanding. Moreover, HTN is one of the few construction enterprises (besides CTD and HBC) which has kept the increase in revenue continuously for the past 5 years.

Listed construction enterprises whose profit has grown continuously since 2013

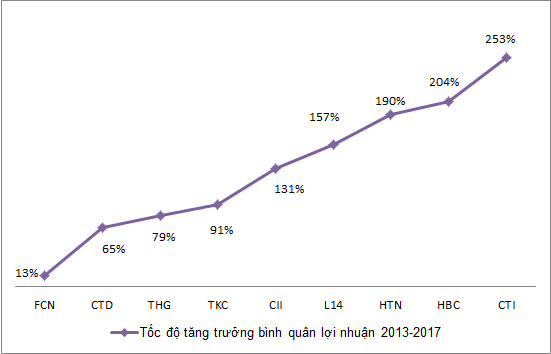

As for the average profit growth rate of HTN in 5 years (2013-2017), it reached 190%, which was higher than many other enterprises in the sector.

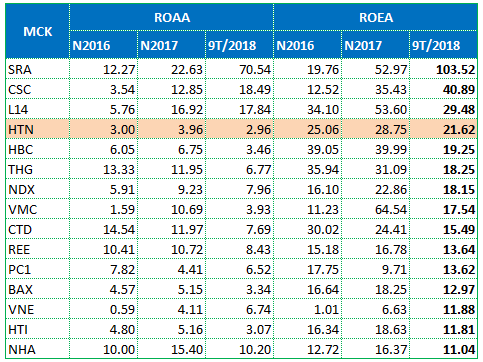

In addition, HTN's business performance is also quite superior to many big-name construction enterprises on the market today. The profit after-tax / Return on Average Equity (ROEA) index in 2016 reached 25.06%; in 2017, it was 28.75% and in 9 months of 2018, it reached 21.62%, significantly higher than the average that construction sector listed: 16.89 %, 21.63% and 8.89%.

Top 15 construction enterprises with the highest ROAA and ROEA in the period of 9 months of 2018

Positive growth prospects of the construction sector

The construction sector market is forecast to continue growing in the next 5 years. The average population growth rate of Vietnam is 1.2 - 1.5% / year and the average urban growth rate is 3.4% / year, which is still much lower than that of ASEAN countries and other countries over the world. Therefore, the potential growth of the domestic housing segment is still very large. At the same time, office demand increases strongly and the industrial-warehousing segment continues to perform well thanks to strong FDI capital.

According to the report of BMI Research, Vietnam's construction sector shall be expected to grow 9.7% in 2018 and annual average shall be 8.2% in the 5-year period (2017-2021). Growth in infrastructure construction is being driven by transport and utility projects invested by the Government in two major cities, Hanoi and Ho Chi Minh City. In addition, investment in housing and commercial construction will continue to be supported by foreign investments.

Positive market prospects will be a great opportunity for enterprises in the construction sector. With outstanding competitive advantages, HTN is gradually asserting as a potential stock.

HTN is currently the general constructor of nearly 30 projects, and this is a great strength to ensure a solid financial source for HTN

By vietstock.vn